Several applications for a Bitcoin (BTC) exchange-traded-fund (ETF) have been sent to the US Securities and Exchange Commission (SEC) for review and approval. The demand for a Bitcoin ETF in the crypto community is also increasing day by day, however, the federal watchdog has rejected many crypto ETF applications due to “significant investor protection issues” and various other regulatory concerns.

The SEC has also cited “liquidity and valuation” issues associated with crypto ETF proposals, which resulted in the denial of such requests. Moreover, almost all Bitcoin ETF applications so far have requested that Bitcoin’s price be tracked through BTC futures contracts offered by financial market companies such as the CME Group and the Cboe.

Due to BTC futures contracts having fairly low liquidity and trading volumes, in addition to such contracts following (instead of leading) volatile spot exchange rates, the SEC has not approved Bitcoin ETFs.

What Is An ETF?

Given all the talk and hype surrounding crypto ETFs, let’s try to gain a better conceptual understanding about them. First of all, what are traditional ETFs? They are basically types of investment instruments and are classified as securities. Most ETFs track real-world assets such as gold, oil, and various other types of commodities.

Investors who acquire ETFs are able to get exposure to a certain asset without actually physically needing to buy it. For example, instead of going through the lengthy process of buying gold, having it get delivered, and safely storing it, you could simply buy an ETF that tracks gold. This way, you can potentially get the same returns from your investment as if you were actually in possession of the gold itself.

An ETF can also be described as a fund whose shares investors can buy while being able to earn dividends or interest from their investment. Additionally, traditional ETFs have been used for many years in traditional financial markets to track benchmark indexes as well. These indexes include the US Dow Jones Industrial Average (DJIA), the NASDAQ-100, and the Standard & Poor’s (S&P) 500.

Indexes (mentioned above) are used by stock market investors as benchmarks to assess how their own investment portfolios are doing compared to the performance of the overall market. Put simply, benchmark indexes are used to gauge “where the market stands.” Asset portfolios, bonds, and commodities are also used as benchmark indexes to determine market performance.

How Traditional ETFs Are Traded

Traditional ETFs are traded on exchanges just like stocks, but with the added advantage of being able to hold a diversified set of funds at the same low cost as holding individual stocks. ETFs can be described as a financial product that consists of a number of diversified securities.

They are also actively traded on a daily basis, and their prices fluctuate throughout the day. One thing in particular that makes ETFs attractive, especially to private investors, is that they can easily trade certain lucrative asset classes in niche markets, which would not otherwise be accessible to them.

Notably, there is no minimum investment amount for ETFs and they mostly track a certain index while also trying to replicate its performance. ETFs work by issuing and redeeming (buying back) shares of stock, however, these types of transactions are not categorized under sales.

Instead, they are considered “in-kind” transactions, which means that capital gains from their trading do not have to be distributed to shareholders. Sometimes though, a minimal amount earned from ETFs trading is given to shareholders. One of the main benefits of this type of trading is that ETFs do not typically have a significant tax liability.

ETFs Are Passive Investment Instruments

Another advantage ETFs have is that they’re passive investment instruments. This means you do not have to pay fees to investment professionals to manage and monitor them. Also, when you purchase ETF shares, you are acquiring shares in a portfolio. This portfolio is linked to a market index and the ETF strictly replicates the performance of its underlying index. Additionally, since ETFs are not managed by a person, there is no risk of a fund manager potentially losing trades against a benchmark index.

What Is A Bitcoin ETF?

So what is a Bitcoin ETF? A Bitcoin ETF would keep track of the bitcoin benchmark index while also replicating its performance, much in the same way as traditional ETFs do. This would let traders with brokerage accounts make investments in Bitcoin (BTC), with the added benefit of not having to go through the technical process of purchasing the cryptocurrency and trying to store it securely.

Moreover, the types of Bitcoin ETFs proposed so far, such as the one by the Winklevoss Twins, had Bitcoin (BTC) as its underlying asset. Therefore, an investor buying such an ETF would also indirectly be buying Bitcoin. However, instead of holding the actual cryptocurrency in their digital wallets, the investor would have a portfolio with a bitcoin ETF. Despite this, it would somewhat be similar to holding bitcoin itself, since the ETF would be tracking the cryptocurrency price.

The primary distinction between purchasing Bitcoin (BTC) and acquiring a Bitcoin ETF is that with the latter, the investor would be holding a regulated investment that is tradable on exchanges without having to deal with how to securely store the investment.

How Will A Bitcoin ETF Affect The Price?

With the introduction of Bitcoin ETFs, there’s a good chance that cryptocurrencies could be added to the mainstream investor’s portfolio. Institutional investors prefer to trade and hold regulated assets and crypto ETFs could encourage them to invest in digital currencies.

A number of market analysts believe that Bitcoin ETFs could help increase overall cryptocurrency adoption, while also significantly driving their prices upwards. One of the reasons crypto ETFs could lead to a surge in cryptocurrency prices is because they could potentially increase their scarcity and liquidity. Usually, when an asset or store of value becomes scarce, there’s a substantial increase in its price.

Compared to when Bitcoin futures contracts were launched, it can be argued that with the entry of Bitcoin ETFs into the market, there will be a more sustainable increase in price. The reason for this is that many investors shifted from the physical crypto market to the derivatives market shortly after Bitcoin futures contracts were introduced.

In addition, most crypto traders were not experienced enough to grasp the supply and demand effects of BTC futures contracts, which then partly contributed to the market crash after their launch. However, with Bitcoin ETFs, investors will actually be trading Bitcoin (BTC) itself. This, in turn, could drive prices towards the higher end in the long-term.

(3.7 / 5)

(3.7 / 5)

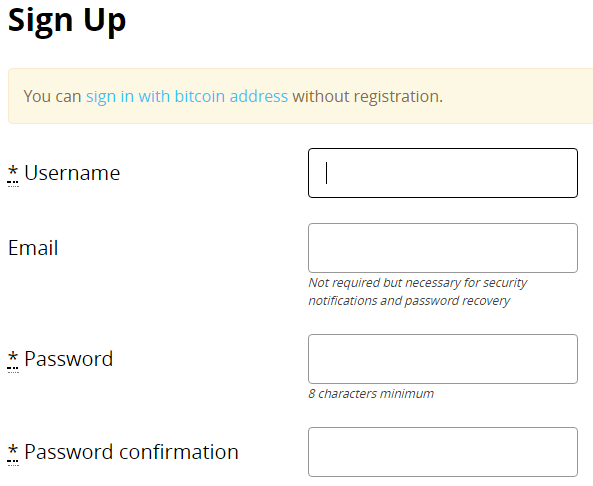

Once this is done you can now start to share your affiliate link with potential advertisers and get 50% of the fees collected from ads that they create.

Once this is done you can now start to share your affiliate link with potential advertisers and get 50% of the fees collected from ads that they create.

(4 / 5)

(4 / 5)

(3.5 / 5)

(3.5 / 5)